Hedge Fund

Hedge Funds

A Preqin Top Prime Broker

Interactive Brokers provides cost-sensitive hedge funds with trading, clearing, custody, reporting and other services.

The IBKR Advantage

- Preqin's #1 prime broker for Hedge Funds with AUM up to $50 million and one of the fastest growing prime brokers for the fourth consecutive year among all Hedge Funds.3

- Interactive Brokers Group (IBG LLC) equity capital exceeds $ billion, over $6.0 billion in excess of regulatory capital.1

- The lowest margin rates, with rates as low as *

- Depth and breadth of short securities availability, transparent loan rates, global reach, dedicated support and automated tools to simplify the financing process.

- No custody fees or AUM minimums and transparent, low commissions and financing rates, support for best price execution, and a stock yield enhancement program to help minimize costs to maximize returns.2

- Invest globally in stocks, options, futures, currencies, bonds and funds from a .

- 100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

- Build customized trading tools, access news, charting and market data, and manage client accounts with our API solutions.

- Integrated OMS / EMS setup offers a one-stop solution for funds looking to reduce costs and improve productivity.

Discover a World of Opportunities

Invest globally in stocks, options, futures, forex bonds and funds from a single integrated account. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

Markets

Countries

Curencies

Learn More

Prime Broker Services

For years, Interactive Brokers has brought advanced technology solutions to our customers. This unique automated approach to prime brokerage builds on our basic principles:

- Around-the-clock global service coverage for Prime Brokerage customers

- Strong balance sheet.

- Strength and security

- Low-risk business model

- Customer fund protection

- Consistent performance

Our continuing dedication to these principles results in Prime Broker Services that deliver real advantages to institutions:

- Custody

- Execution and clearing

- Securities financing

- Margin financing

- Take up trades from other brokers

- Corporate actions

- Customer service

View our Due Diligence Information for Advisors, Brokers, Hedge Funds and Other Financial Institutions

and Intermediaries using or considering Interactive Brokers LLC as Prime Broker/Custodian.

Trading Technology to Help Hedge Funds Succeed

Trading Platforms

Powerful, award-winning trading platforms and tools for managing client assets. Available on desktop, mobile, web and API.

Order Types and Algos

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

API Solutions

Our proprietary API and FIX CTCI solutions let institutions create their own automated, rules-based trading system that takes advantage of our high-speed order routing and broad market depth.

Sophisticated Risk Management

Understand risk vs. returns with real-time market risk management and monitoring that provides a comprehensive measure of risk exposure across multiple asset classes around the world.

Fractional Trading

Buy or sell any eligible US or European stocks/ETFs using fractional shares, which are stock units that amount to less than one full share, or by placing an order for a specific purchase price rather than quantity of shares.

Advanced Trading Tools

Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools.

Free Account Tools

Manage taxes and corporate actions, learn about T+1 settlement and trade allocations, and read about additional tools and services available to clients.

Soft Dollar Commission Program

Interactive Brokers' Soft Dollar Commission Program gives hedge funds and Professional Advisors the flexibility to offset the costs of purchasing approved research products and services using soft dollars.

As defined under the Securities Exchange Act of 1934 section 28(e), a portion of commission dollars can be set aside to pay research-related costs incurred by advisors and fund managers. Eligible IBKR Clients can specify amounts that can be added to IBKR commissions and set aside as a pool of available money (Soft Dollars), which can be used to pay for market data and research.

IBKR Clients can then pay allowed expenses for market data and research subscriptions to external vendors. Allowed categories of expenses include fundamental, technical and/or quantitative analysis; portfolio management, valuation and asset allocation services; and economic forecasting.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls protect IBKR and our clients from large trading losses.

IBKR

Nasdaq Listed

$B

Equity Capital*

%

Privately Held*

$6.0B

Excess Regulatory Capital*

Client Accounts*

Daily Avg Revenue Trades*

IBKR Protection

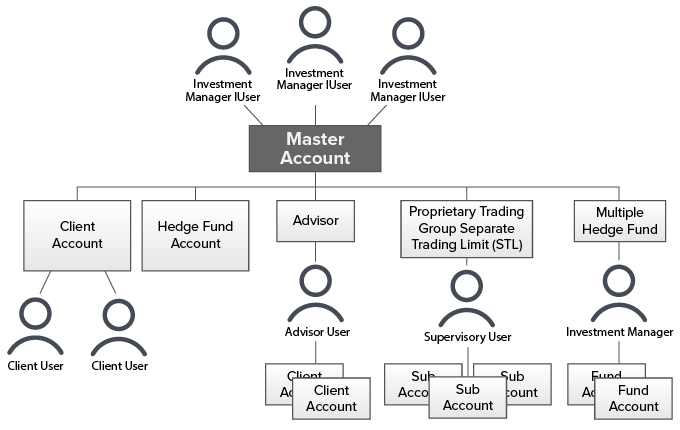

Hedge Fund Account Structure

Multiple funds managed by an investment manager with a master fund admin account.

Additional Information

The investment manager can add separately managed client accounts.

Each fund account can be owned by a separate legal entity and is credit-managed separately.

Execute trades for multiple funds in an Allocation Account and assign trades before the end of the day to specific cleared fund accounts.

Pre-trade allocation tools.

The investment manager can create multiple tier accounts by adding Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master accounts to their account structure. Each Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master account holder can add client, sub and hedge fund accounts as required.

Link to Administrators for the purpose of providing administrative services such as reporting to your clients. Shop for registered Administrators at the Administrator Marketplace.

Open a Hedge Fund Account

Our Hedge Fund accounts let Investment Managers set up different structures to meet their needs.

Interactive Brokers offers two different Fund account structures: Multiple Fund and Allocation Fund accounts.

Hedge Funds are highly speculative and investors may lose their entire investment. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Supporting documentation for any claims and statistical information will be provided upon request.

Hedge funds are highly speculative and investors may lose their entire investment.

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- Supporting documentation for any claims and statistical information will be provided upon request.